Economic Winds of Change

Published: Tue, 09/06/22

Like it or Not USA and its economic/monetary direction is driving what happens to world markets today. Ignorance is bliss if you do not believe so.

Today's piece tries to put together some of the most important charts that I came across recently and connects the dots of where we are in the cycle.

Economic Winds of Change

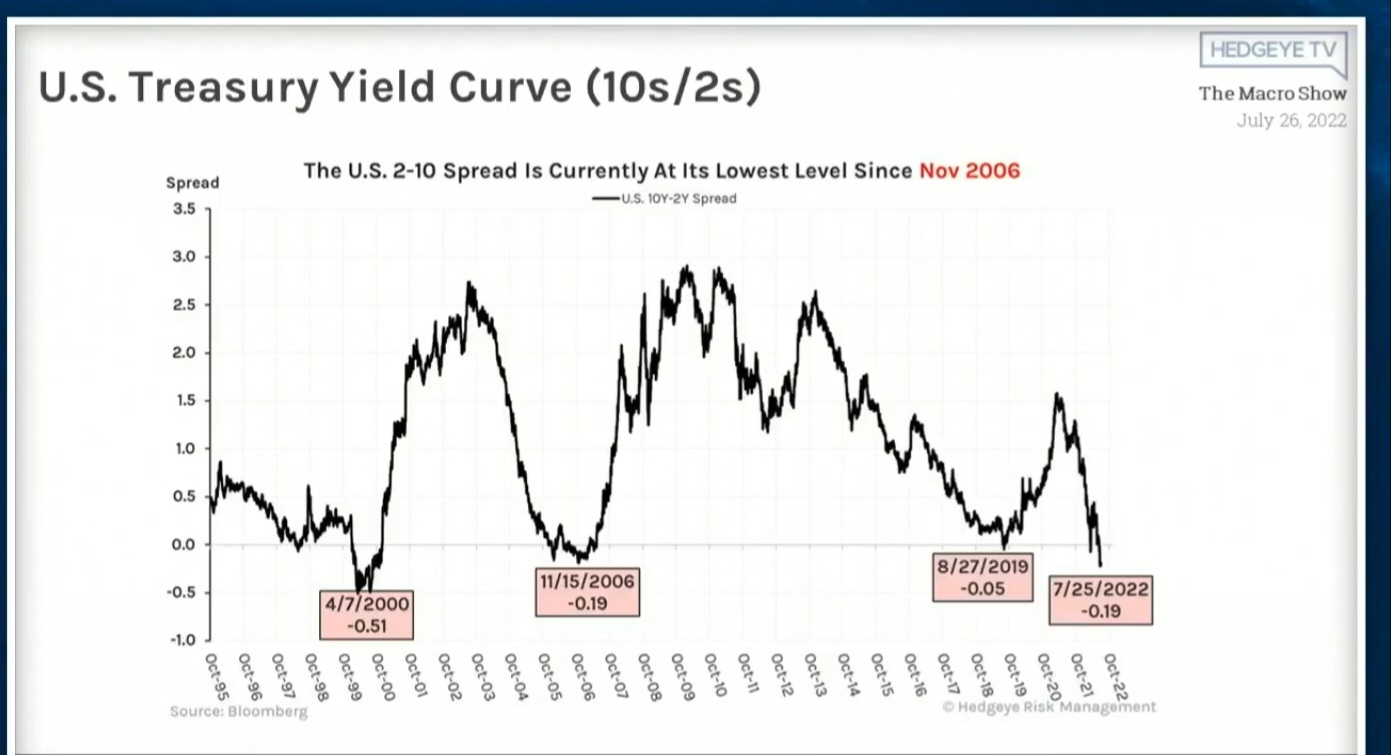

A lot has happened since the yield curve inverted, predicting a recession in six months. Now what that really means is not that the recession will arrive in six months, it means that things may get bad enough that it gets recognized. At that point in time, the FED will change policy and start cutting rates, and the yield curve steepens again. Some of the biggest crashes occur around this time in markets, as the markets recognize that a recession is here, and money starts to move out of stocks into bonds in a risk-off trade or a flight to safety. This is why the bond market bottoms before the stock market. But we are not there yet. The bond market is still falling, and yields rising.

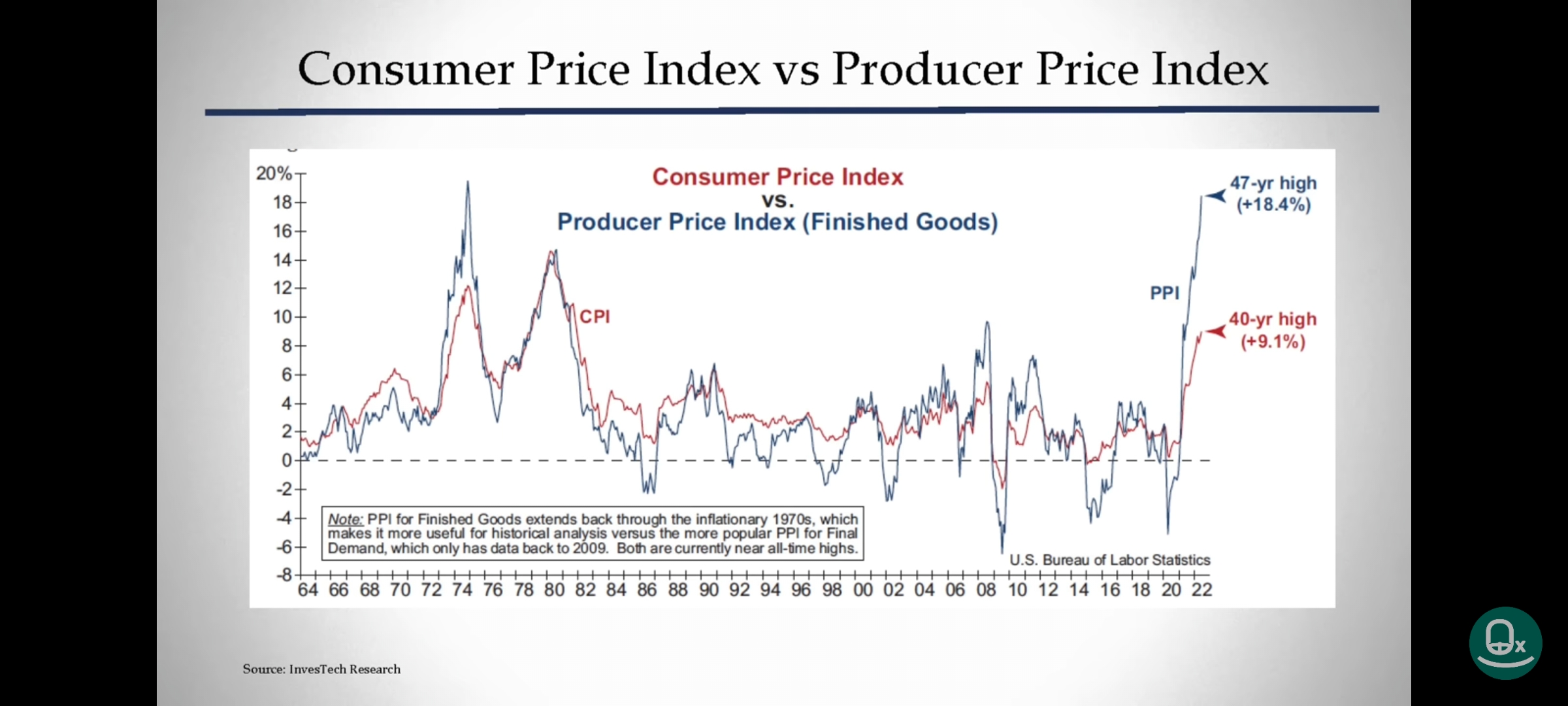

This time is different, a little. By this time, rate hikes are behind us. The reason it did not happen this time is that inflation was far more out of control. When Oil hit 144$ in 2008, inflation was not this big a problem. India raised rates once, but the US did nothing. At this point, we are still on the hiking cycle. The chart below shows how PPI has raced far higher than CPI as producers raced to pass on costs.

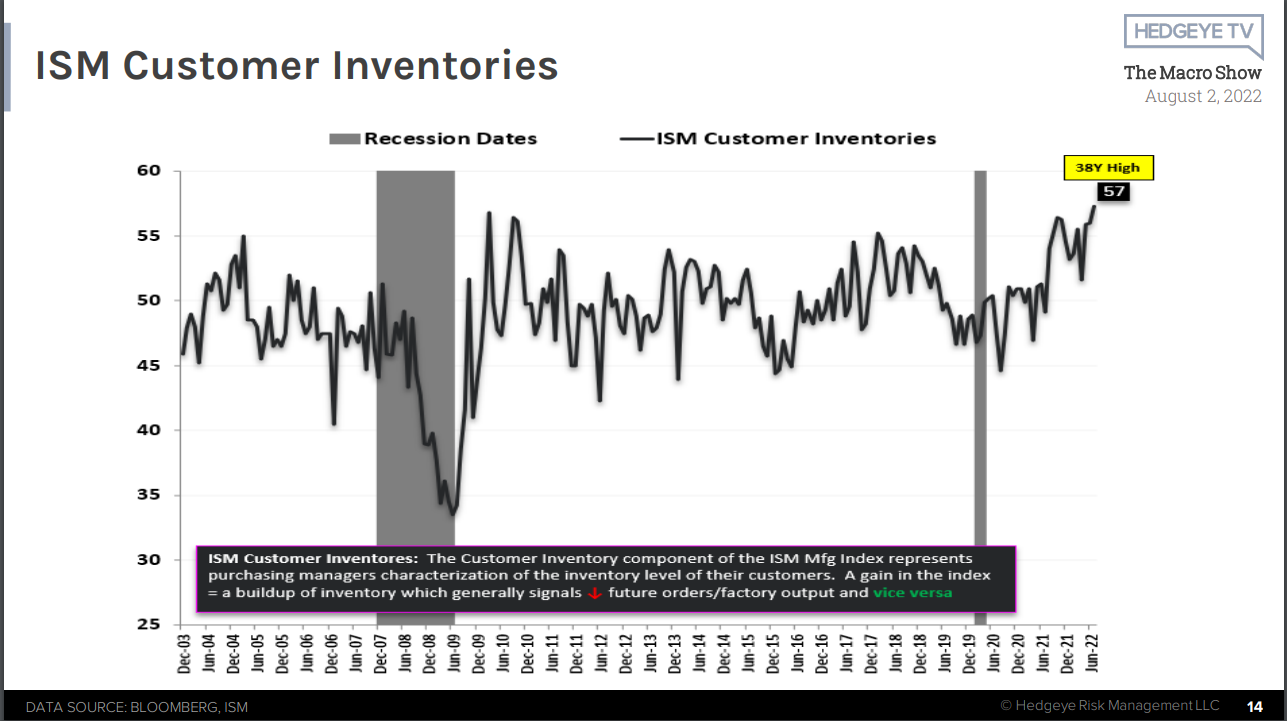

The result of rising prices often is re-stocking, and we see some sense of that below, with increasing inventories. Preponement of demand can be one of the side effects of inflation both at the consumer and producer levels. This is why containing inflation expectations becomes essential. It results in consumer behavior toward consumption. If we choose to buy more today, then we only create more shortages.

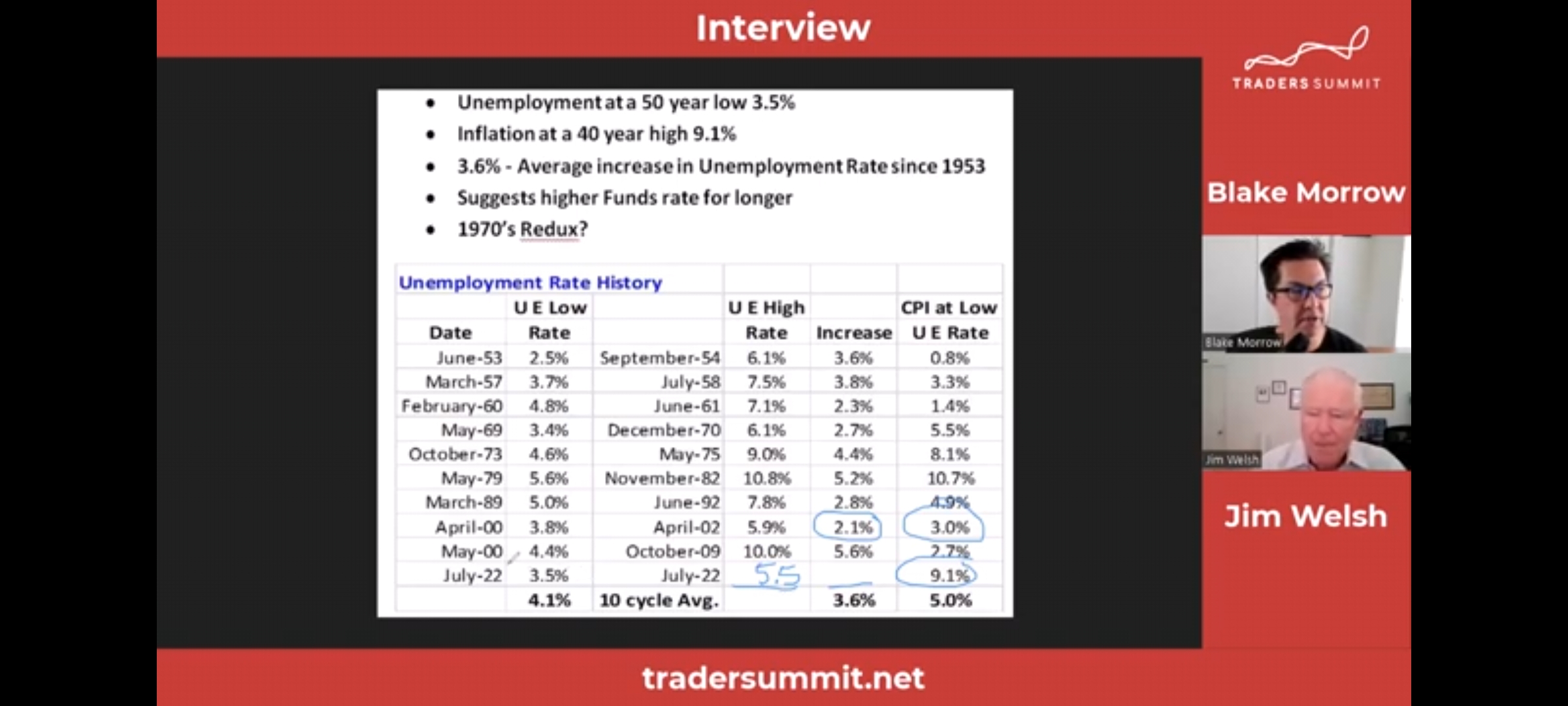

This unusual mix between a high rate of inflation and a low rate of unemployment and the resulting consumer behavior has made it difficult for the FED to cut rates quickly even as the underlying growth momentum slows. Higher for longer has become the mandate.

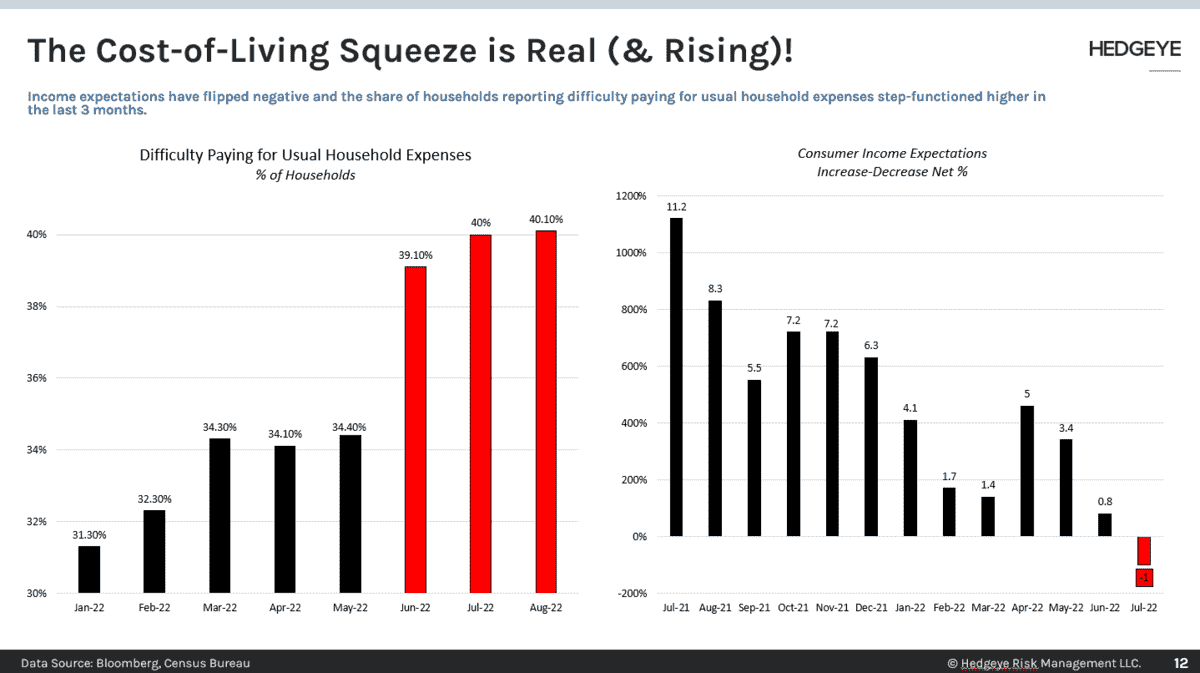

So as growth slows, raising wages might not be possible and the cost of living, in general, is going to tighten up.

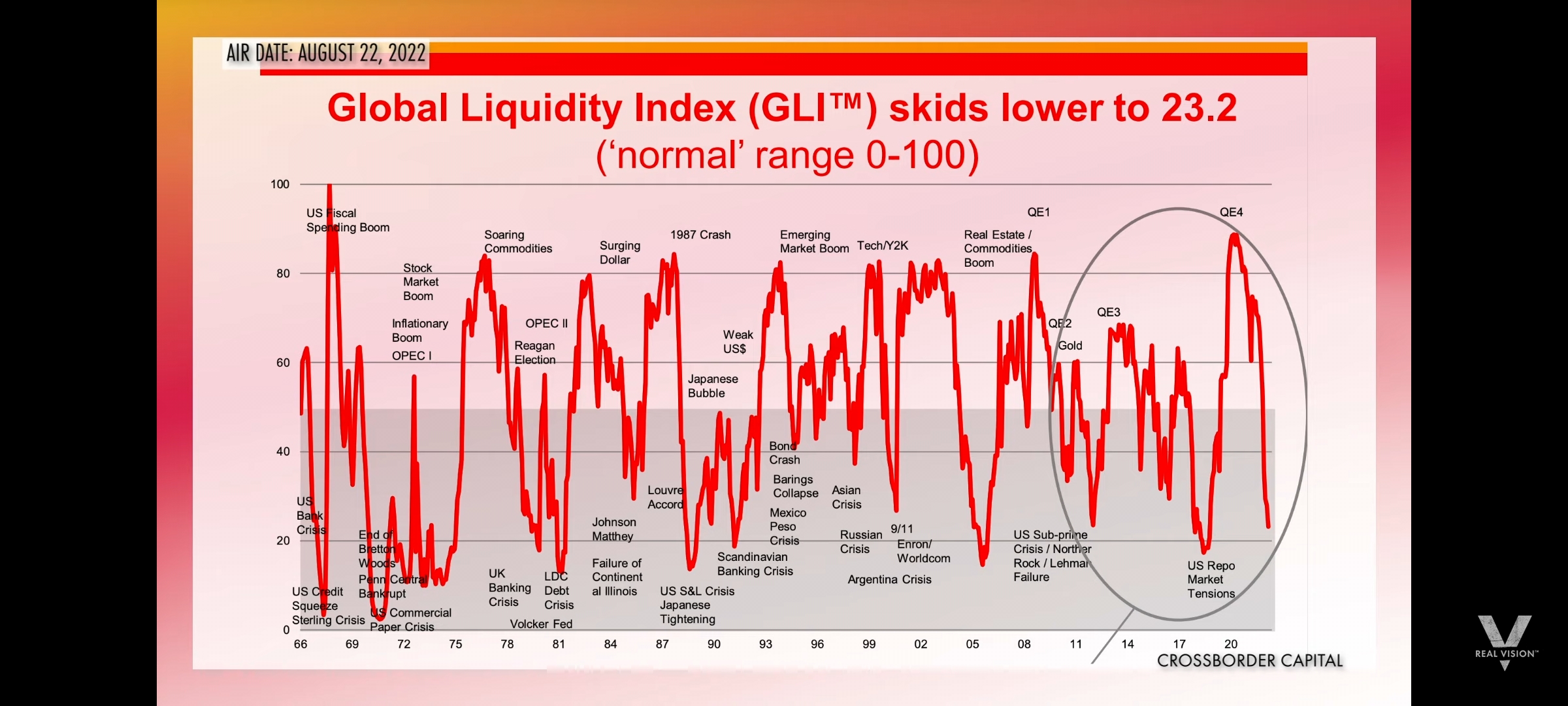

On the other hand, the high-interest rates and QT are simultaneously hurting where it hurts. Liquidity. Every time we have been here below 20 in the past there has been a financial crisis, and that has been followed by a flood of liquidity, in that order. Now we should be looking out for the first thing, the financial crisis.

Rohit Srivastava

The Truth About the Markets

Rohit Srivastava

www.indiacharts.com

For accurate market analysis. Technical analysis is a study of past data to assess future probable outcomes. It is our endeavor to discuss high probability set ups for traders and investors in good faith. However this is not a solicitation to buy or sell stocks futures or options or any security. Trading in any financial market should be done with sound knowledge and the help of a qualified investment adviser. Stocks based on the Elliott wave model are based on the Fibonacci fractal of the market and momentum indicators, Levels are based on Fibonacci maths and are only indicative of what the mathematical model throws up. Readers may download the free Elliott Wave Calculator to do it themselves. This is not a research report. We are not investment advisors This is not a recommendation to buy/sell.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Value Wave Stocks discusses the short term trading set ups that we use while taking our trading decisions. Value wave Investments. discusses the long term set ups that we use while taking our investment decisions. We may have holdings in these stocks and are interested in these opinions. This is not the only reason considered while taking our actions. Kindly take the help of a qualified investment advisor before trading. We have active open long and short positions in the futures/options/stock/commodity/currency markets at any point of time. The opinions here are for your education and understanding only of how we identify stocks to trade/invest in. We change our opinion daily and even hourly. Any actions taken by you are at your own understanding and risk. We do not offer personalised advise or research of any kind.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

You have received this mail because you signed up for it on our website and agree to our https://www.indiacharts.com/terms-and-conditions and https://www.indiacharts.com/privacy-policy listed there. If not, you may unsubscribe with the link below at any time.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Please do not reply to this message. email to indiacharts@gmail.com

I 305 Ekta Bhoomi Gardens

Dattapada Road Borivali East

Mumbai Maharashtra 400066

INDIA

Unsubscribe | Change Subscriber Options