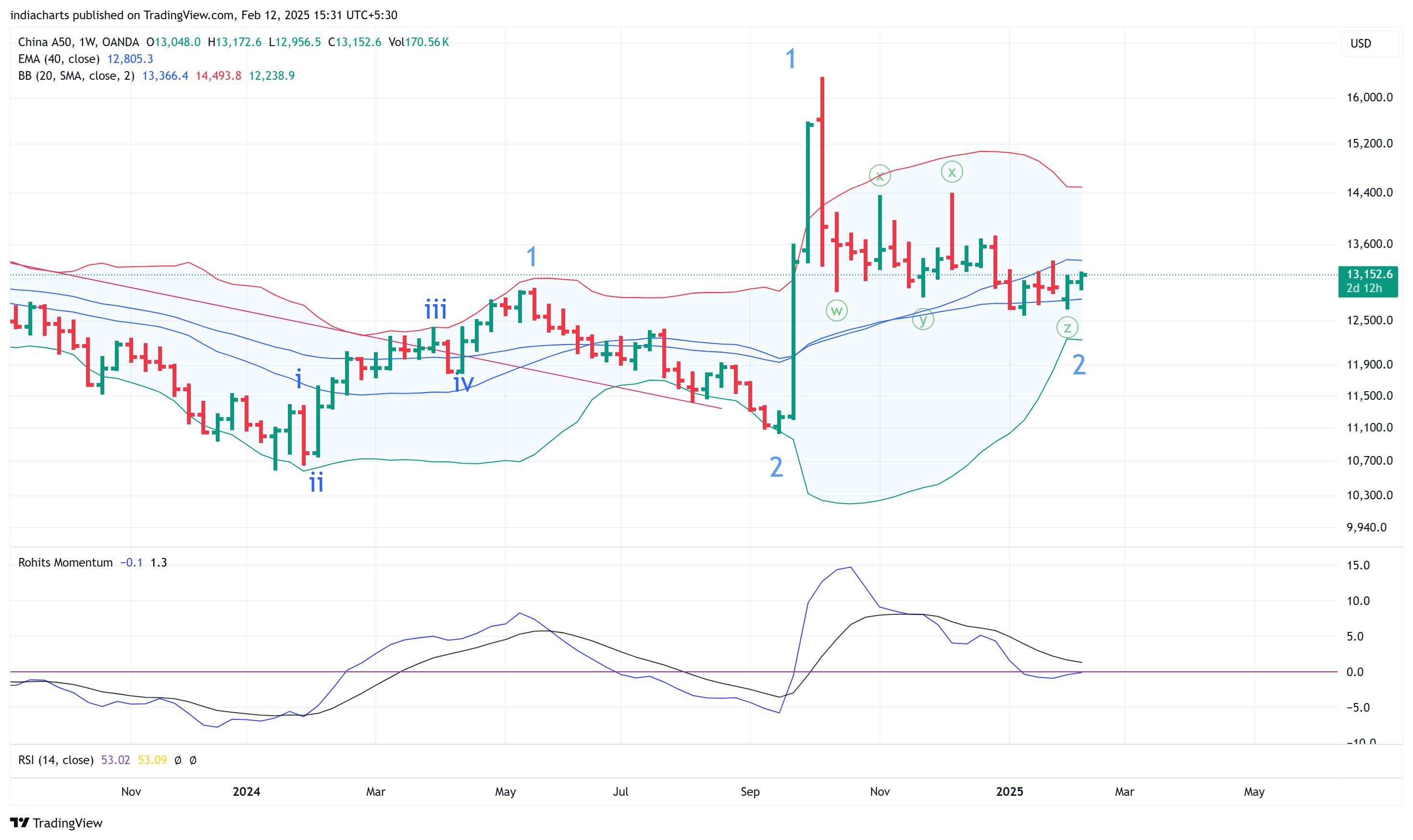

The return of China

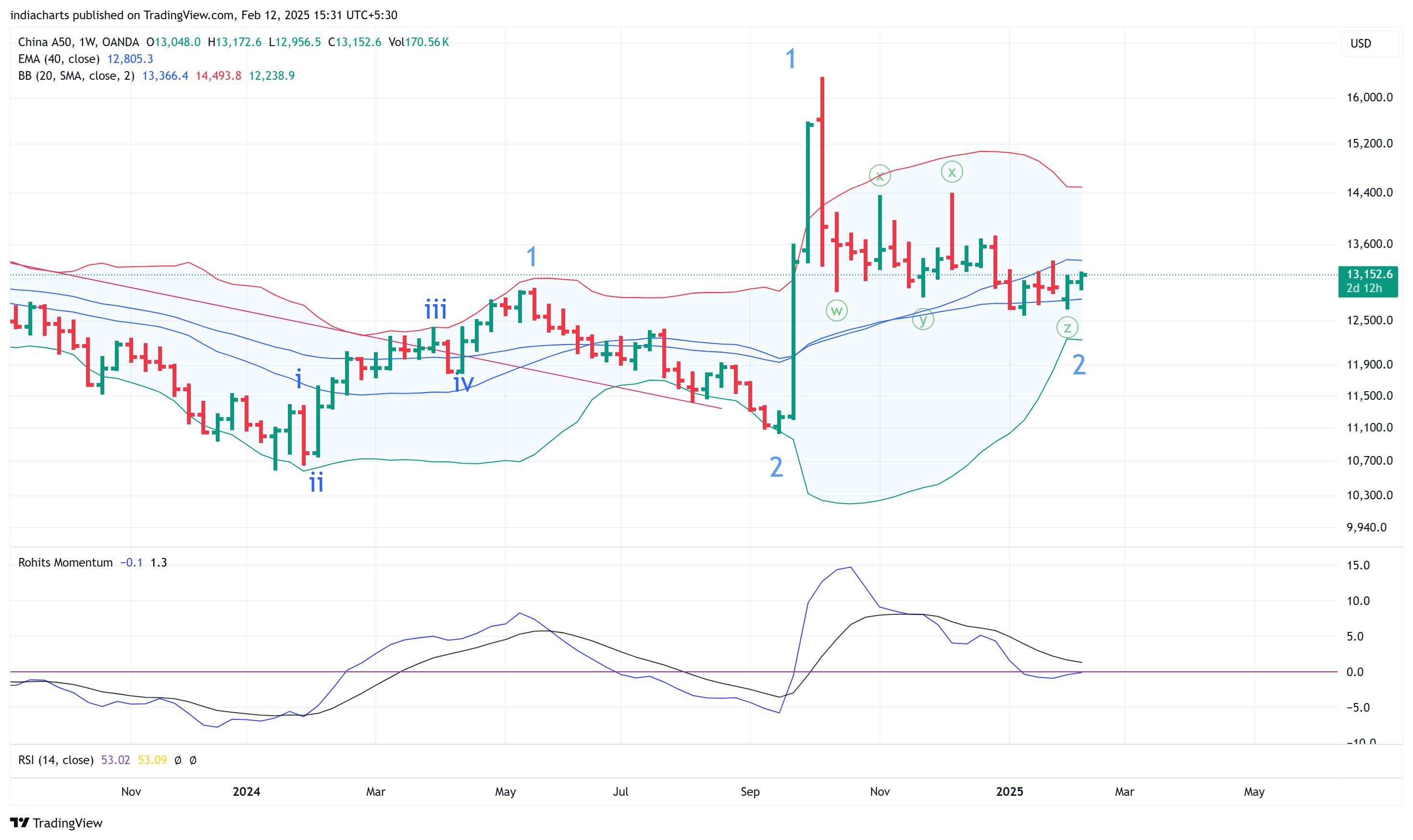

In Oct after the stimulus rally I said China will underperform because it moved too fast. It did and so did India. But now after months the weekly chart shows wave 2 coming to an end with

multiple support being taken on the 40wema. The daily RMI is bullish and weekly will take some time but it is time to think about the return of China growth stimulus in wave 3 of 3 higher. Oh I hear that you are worried about Tariffs - that is a tax - what has that got to do China's internal policy. I have no idea that chart looks good as of now that is all.

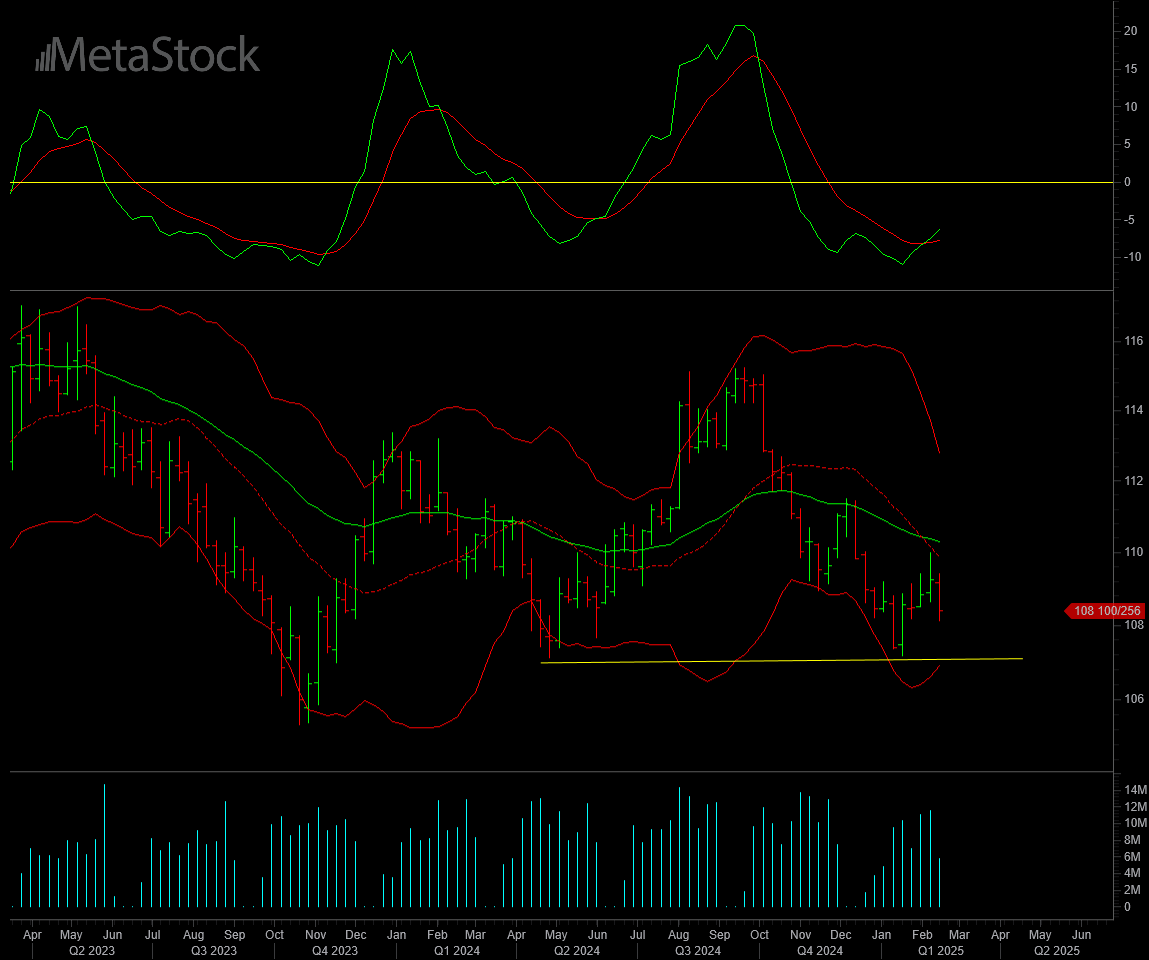

US 10 year notes

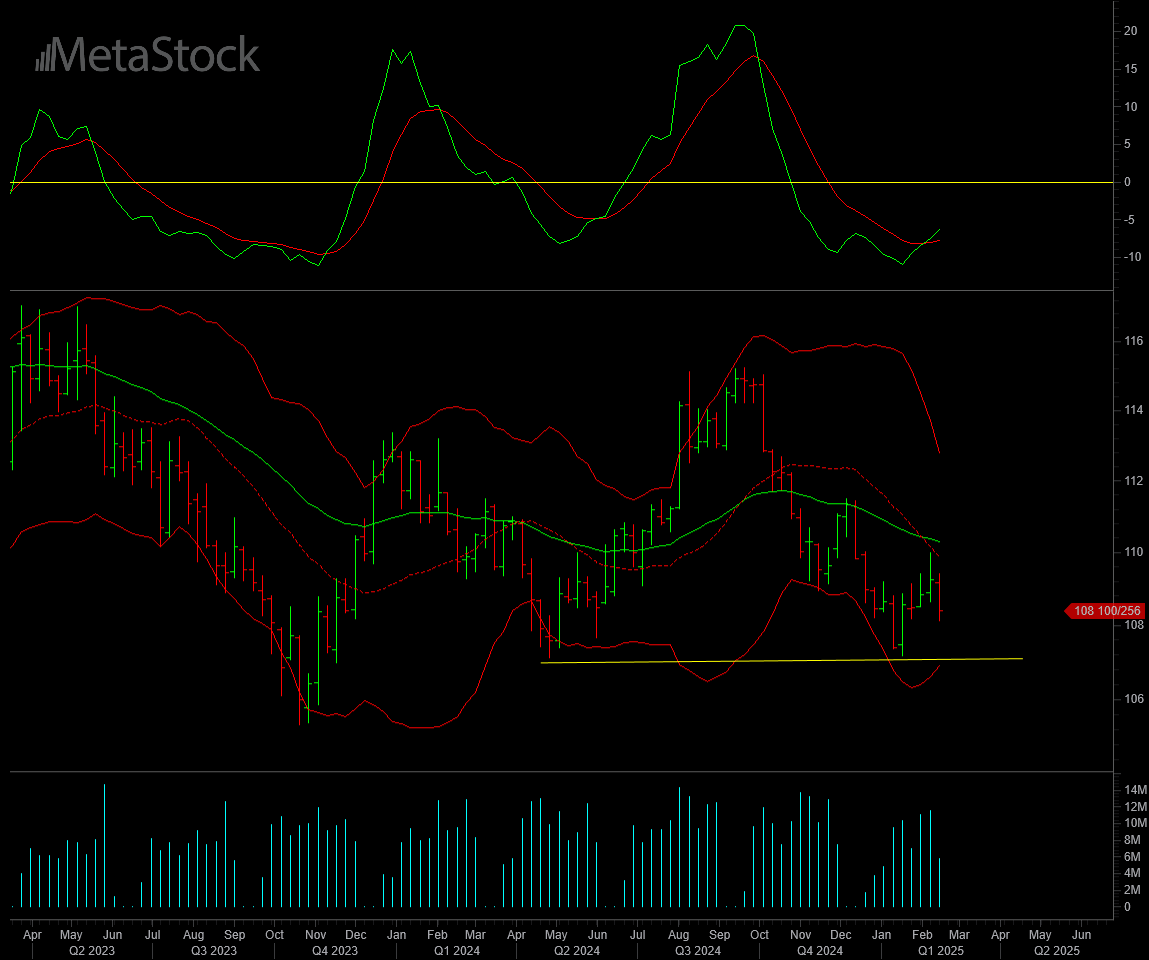

A look at the 10-year note chart [not the yield] gives a different picture. The weekly chart shows that prices took support near the Apr'24 low and bounced, pushing the weekly RMI to bullish. The recent fall is down to the lower band and 61.8% retracement

only. Yes, we did not go above the 20wma yet, but this is not conclusive. The failure to make new lows in an extremely short market, where most are bearish, is a warning that something can change. So when there are bulls and bears on the bond market, let the markets confirm who is supreme. The divergence is between central bank policy and bond yields itself.

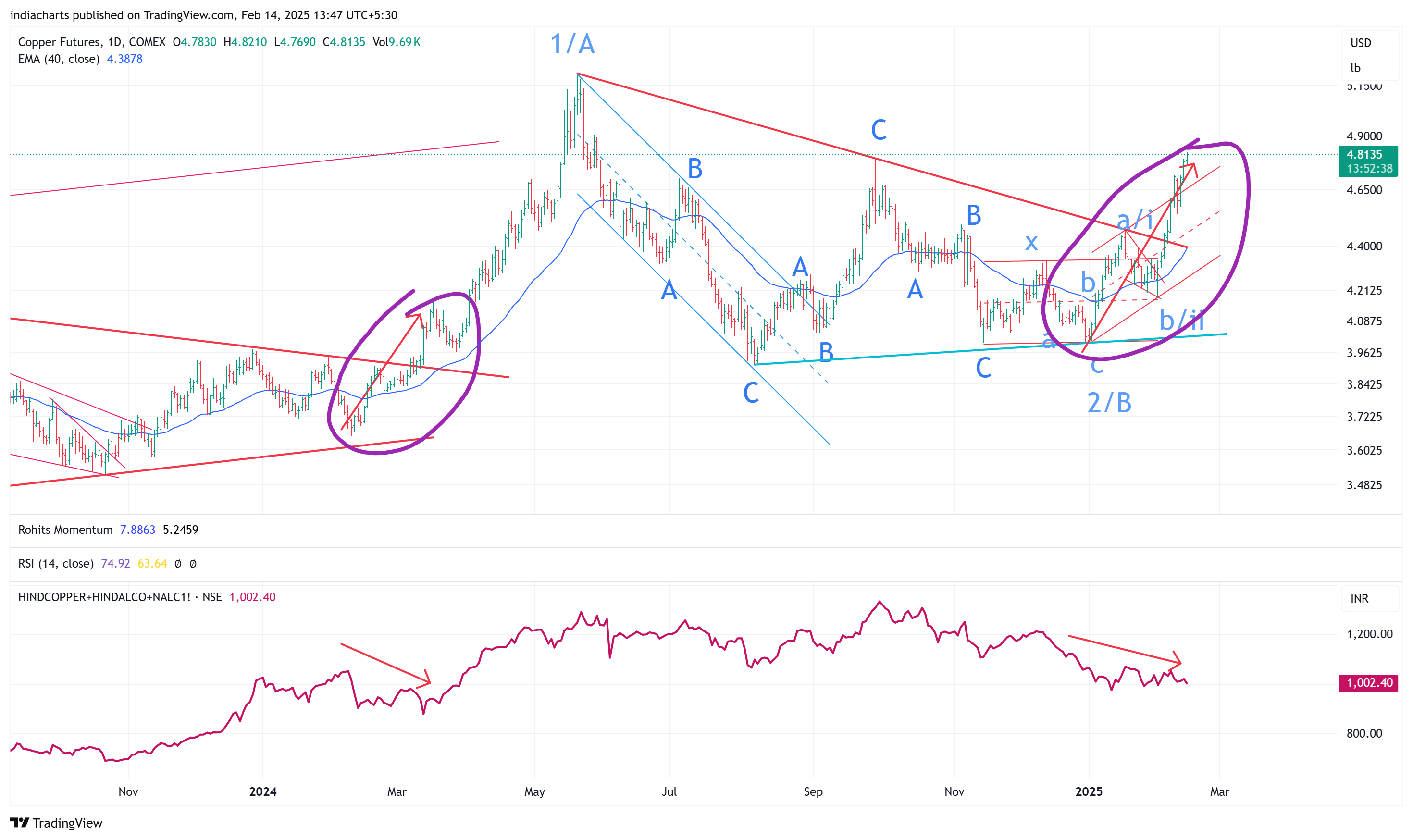

Copper and Copper stocks

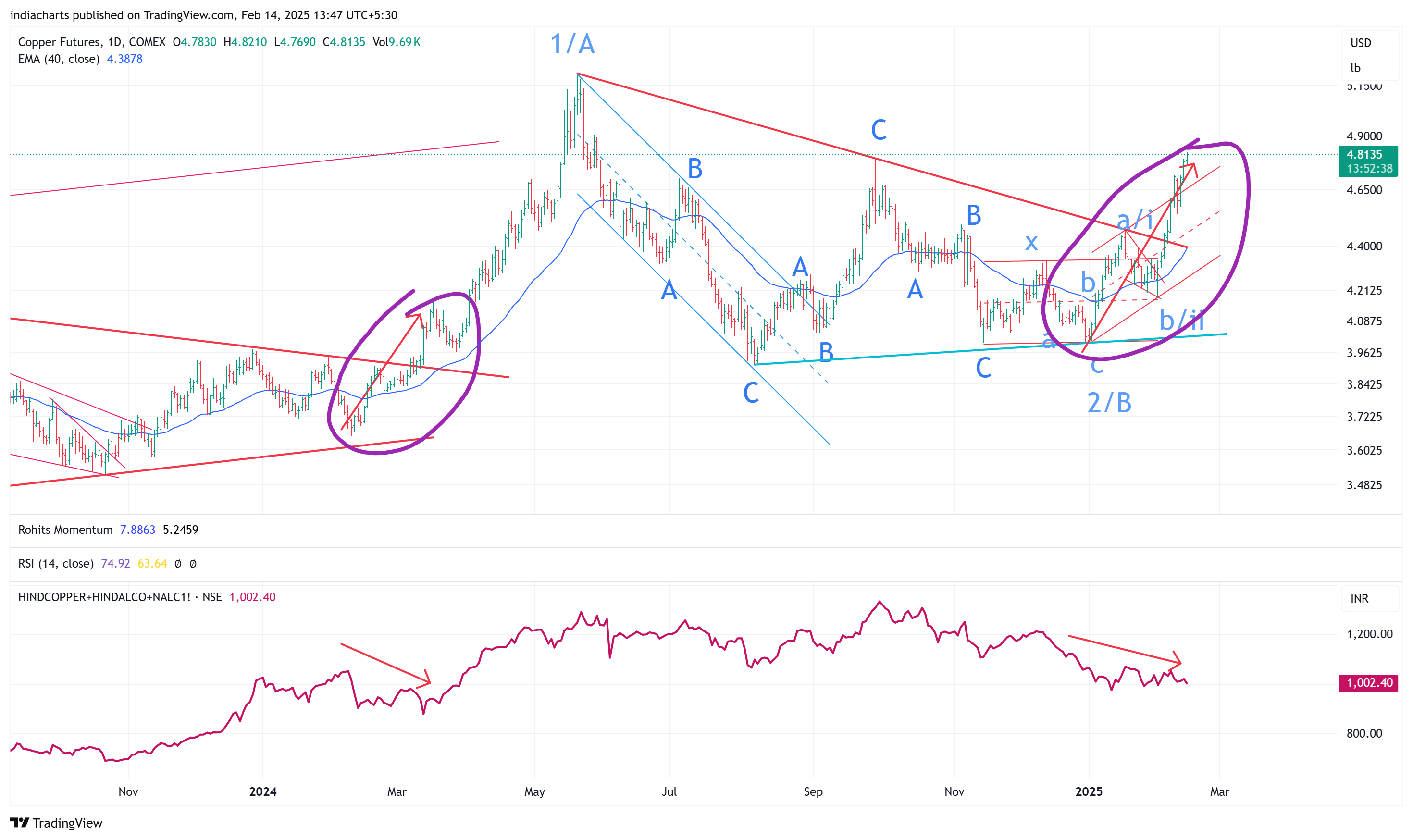

The chart shows Copper prices with an index of copper and aluminium producers. The index is price-weighted, but the idea is to show inter-market divergences. While the two are usually correlated as they should be, sometimes the price of copper can lead to the

underlying. You must choose whether the commodity's price is correct or the stock. One of them will catch up with the other. When Copper prices rose a year back, they broke out first and led the way. Only later did we see a catch-up from stocks. We have had a breakout in copper prices this time, but copper stocks are still falling. Let us see if the same can be repeated.

A world Awash in Liquidity

The Power of Liquidity

If you have ever wondered why I call these reports winter updates, it has much to do with the Kondratieff

winter, when countries try to deal with their debt problems once in a generation. Ever since Covid, I have wondered if the time has come to change the name to the Economic Spring. But clarity is missing. Are we beyond the point of deflation, and is inflation managing to do the job of working off the debt? Maybe we will only know in hindsight, but where are we today on this issue?

In

the most recent quarter, bond yields have been rising in the United States and Japan, which has triggered many Asian and Emerging markets to give up their gains, but on the other hand, what has been ignored is why European markets are near all-time highs. Europe has been through an entire year of economic slowdown. Japan also has not exactly fallen much trading in a range for months.

India has witnessed one of the most severe corrections in recent history. So, while all this can mean that we are in trouble, we can get a different answer

if we think about what keeps the world ticking. The world has been trying to stay afloat using liquidity and currency management. The idea is to inflate and avoid hyperinflation. It appears to be working at times, and at other times, it does not. The reason is the impact of divergent policy actions worldwide and that we pay too much attention to the United States of America. The chart above shows EEM going up while US 10-year bond yields fall, but India, which was affected by the same below, is

breaking away in the near term. No recovery even as bond yields go down. This is because our own liquidity measures were delayed.

The US may be the elephant in the room, but it plays this game with all the partners. So, when global policy is toward lower interest rates, the US appears to hold its own, taking no action. When the US tightened in 2022, everyone else was not raising rates. These actions resulted in country-specific currency and bond market movements, and they managed to keep each crisis local without contagion. These are policy

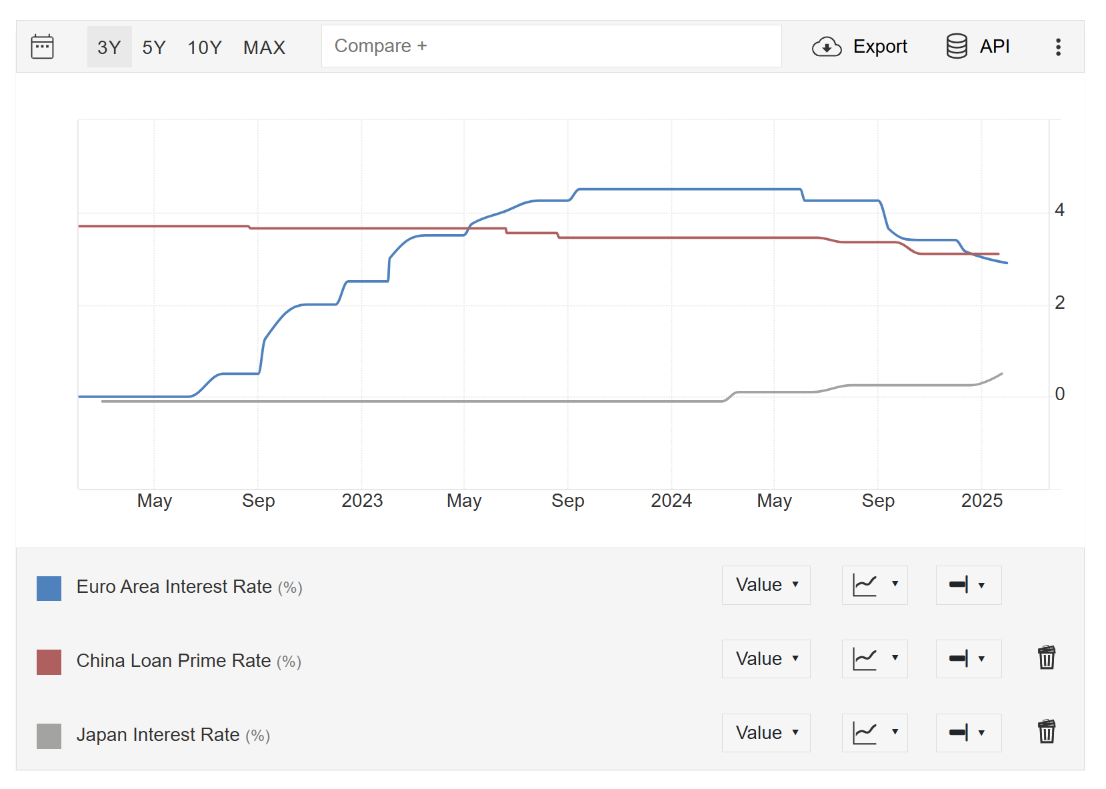

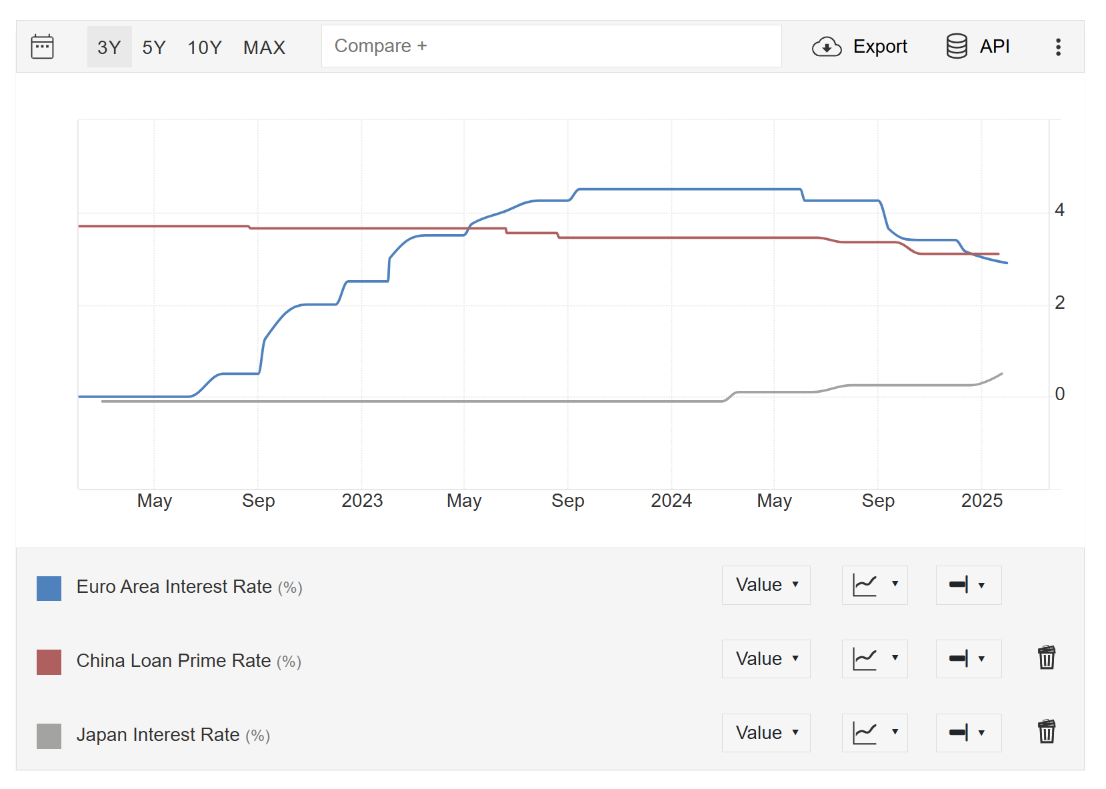

divergences in the near term. You must look at the chart below to see the near-term divergences. While rates are being cut, the US has stopped while Europe is still cutting, and India only did its first this month [red].

86909.png)

We are simple minds, and despite knowing this truth since 2014, when Europe and Japan weakened their currencies to fight the crisis and pushed the dollar higher, it is hard for even the seasoned player to understand. The dollar rose back then, not due to US actions but to actions of other nations.

Remember, the DXY is an index of cross rates, so if the Euro and Yen fall, the dollar goes up.

This year has been no different. In 2022, when the dollar was rising, the US raised rates to fight inflation. Remember, Europe and Japan denied higher rates for very long. Japan started raising rates only in the second half of 2024. The chart below shows Europe's rising and lowering

rates much faster, but China's slowly lowering them throughout the years. Japan started to raise them only in the last third of the period. Impact? Japan is keeping liquidity high and the Yen weak for longer than usual [good for Japan stocks and pushes the dollar higher].

In 2024, when the dollar is rising, it is because Europe is cutting interest rates. Japan is weakening the yen, and China is stimulating its way out of a potential

depression. So the US cuts rates twice and stops, but everyone else continues. Impact? Strong dollar due to weak Euro Yen CNY, Swiss Franc, GBP, etc.

This cause-effect is essential. A strong dollar due to US-related actions hurts everyone, including the US. A strong dollar due to other AEs taking action hurts EMs but not everyone else that much. When the Yen is weakened, Japan stocks go up; when Europe stimulates, European stocks rise [now at all-time highs], China has been slowly stimulating = many

short term rallies in China but it is now making higher highs and lows long term.

India has been the last to move. That is what I meant on Twitter, that we are the last market to find a bottom because our policy in 2024 was exceptionally tight. We did not allow the rupee to fall like everyone else, making it the strongest currency on board for no logical reason. We did not cut

interest rates for the entire year. Govt was spending below budgeted levels. The list is long. But we are now on the cusp of that change. All other markets considered as slowing or headed to a recession are being saved from a technical bear market due to liquidity. India is the last one to join the tribe now. The end result maybe no different.

I will use this base case to discuss the

outlook for the Indian stock markets in my upcoming long-short report.

86909.png)